美国前总统唐纳德·特朗普在纽约受审3.7亿美元的民事诉讼这可能会改变帮助特朗普入主白宫的个人财富和房地产帝国。

特朗普,他的儿子们埃里克·特朗普和小唐纳德·特朗普。,以及特朗普公司的其他高管被纽约司法部长莱蒂夏·詹姆斯(Letitia James)指控参与了一项长达十年的计划,在该计划中,他们使用“大量欺诈和虚假陈述行为”来夸大特朗普的净资产,以获得更优惠的贷款条款。该案件的法官做出裁决后,审判就开始了部分简易判决特朗普提交了对其资产的“欺诈性估值”,让审判来决定其他行动以及被告应该受到的惩罚(如果有的话)。

这位前总统否认了所有不当行为,他的律师辩称,特朗普所谓的虚高估值是他商业技巧的产物。

詹姆斯说,这个案子从来都与政治无关

纽约州总检察长莱蒂夏·詹姆斯(Letitia James)在结案陈词结束后对法庭外的记者发表讲话,驳斥了她对唐纳德·特朗普(Donald Trump)的指控与政治有关的说法。

“这个案子从来都不是关于政治、个人恩怨,也不是关于骂人。这起案件关乎事实和法律,唐纳德·特朗普先生违反了法律,”詹姆斯说。

詹姆斯感谢她的团队、法官和特朗普的律师,然后重申她对该案“正义将得到伸张”的信心。

“无论你多么强大,无论你多么富有,没有人可以凌驾于法律之上,”她说。

结案陈词结束,预计1月31日做出裁决

法官亚瑟·恩戈伦(Arthur Engoron)要求州检察官凯文·华莱士(Kevin Wallace)将特朗普的欺诈行为与金融家伯尼·麦道夫(Bernie Madoff)的行为进行比较,以结束当天的诉讼程序。麦道夫在20世纪90年代和21世纪初从客户那里骗取了数百亿美元。

"你如何比较你所指控的欺诈和马多夫庞氏骗局?"恩戈伦说。

在一次曲折的回应中,华莱士承认特朗普的欺诈规模较小,但“鉴于涉及的美元金额,意义重大”。

“如果你足够富有,你将被允许这样做。你会逃脱的,”华莱士说。

恩戈伦在当天结束时估计,他将在1月31日之前就此案发表意见。

然后,他结束了诉讼。

国家律师说,责任止于特朗普

州检察官安德鲁·阿米尔(Andrew Amer)表示,责任在于唐纳德·特朗普(Donald Trump),法院应该让他为自己公司的行为负责。

“责任止于他,所以他要对我刚才审查的所有行为负责,”阿米尔谈到特朗普在2011年至2015年期间的行为时说,特朗普赢得白宫后,他的儿子们接管了公司。

尽管辩护律师一再批评前特朗普律师迈克尔·科恩的证词,但阿米尔强调,特朗普的律师从未质疑过这位前总统关于特朗普指示科恩和时任首席执行官艾伦·韦塞尔伯格“的证词反向工程“他的财务报表增加了他的净资产。

“根据他们不在这一关键点上质疑特朗普的决定,法院应该推断反向工程指令是特朗普发出的,就像科恩描述的那样,”阿梅尔说。

阿米尔还强调了他所说的埃里克·特朗普前后矛盾的证词关于他对他父亲财务状况声明的了解。

“他竭尽全力向法庭隐瞒,他完全知道他的父亲有一份个人财务报表,”阿米尔说,声称埃里克·特朗普和他的兄弟小唐纳德·特朗普“批准并延续了那些旨在欺诈的计划。”

然而,法官恩戈伦似乎对阿米尔关于特朗普成年儿子的说法持怀疑态度——特别是小唐纳德·特朗普——并打断了总结,向阿米尔提问。

“你有什么证据——我只是没有看到——证明他们知道有欺诈行为?”恩戈伦说。

阿米尔回应说,鉴于儿子们在公司的角色,他们应该知道欺诈行为,他们的不作为相当于“把头埋在沙子里”。

“他们不能说他们没有注意到这一点。这根本不是辩护,”阿米尔争辩道。

国家声称“现金短缺”驱使特朗普欺诈

州检察官凯文·华莱士(Kevin Wallace)在总结时表示,唐纳德·特朗普(Donald Trump)2016年总统竞选的成本和他的商业义务之间的竞争义务,在特朗普集团造成了“现金紧缩”,促使这位前总统实施欺诈。

华莱士关于涉嫌欺诈动机的理论是他首次阐述的,试图解释特朗普涉嫌行为的动机,并证明对特朗普征收罚款是为了规范市场。

根据华莱士的说法,特朗普集团通过欺诈节省的数亿美元使该公司在2010年的一次重大“现金紧缩”中“保持运转”。

华莱士说,在这十年的前五年,特朗普集团花费了大约7.75亿美元来翻新房产,包括其Doral和Turnberry高尔夫球场,以及华盛顿特区的旧邮局大楼。Wallace认为,公司可以单独用现金支付这些费用的想法是一个“幻想”。

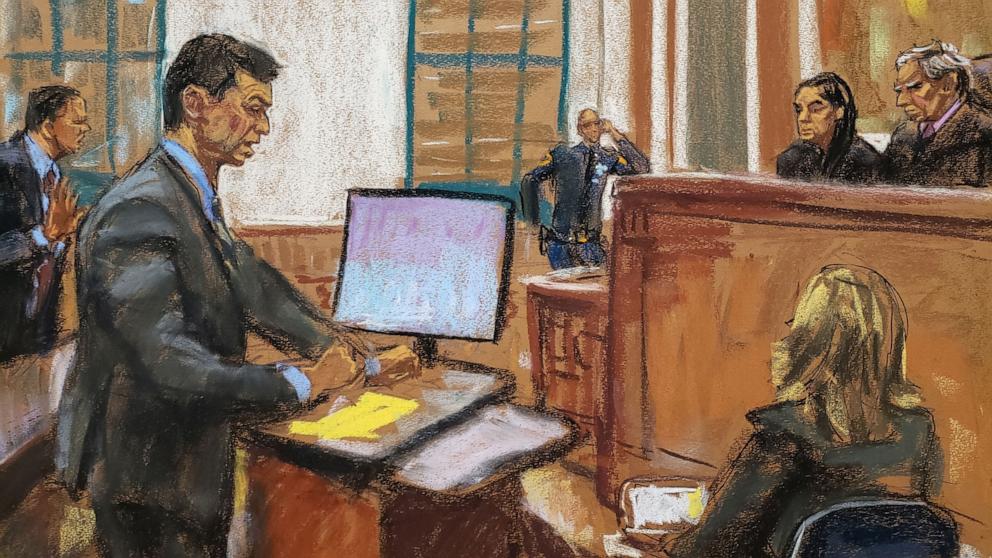

简·罗森伯格/路透社

律师凯文·华莱士在特朗普组织民事欺诈案审判中做结案陈词.

“到2017年时,特朗普先生将成为总统,而公司的现金越来越少,”华莱士说。华莱士称,面对负现金流的可能性,该公司选择了接受欺诈。

“他们不必在优先事项之间做出选择,”华莱士在谈到公司的业务支出和特朗普的总统竞选时说。

特朗普的律师克里斯·基斯(Chris Kise)反对这一说法,认为这一理论只不过是猜测——这引发了与华莱士的激烈交流。

“克里斯。停下来。我们根本没有打断被告的陈述,”华莱士面对基斯喊道。

“我想我同意Kise先生的观点,”Engoron法官回答道,但是他允许继续陈述。

Trump fraud trial: Trump maintains innocence as state says 'buck stopped with him'

Former President Donald Trump is on trial in New York in a$370 million civil lawsuitthat could alter the personal fortune and real estate empire that helped propel Trump to the White House.

Trump, his sonsEric Trump and and Donald Trump Jr., and other top Trump Organization executives are accused by New York Attorney General Letitia James of engaging in a decade-long scheme in which they used "numerous acts of fraud and misrepresentation" to inflate Trump's net worth in order get more favorable loan terms. The trial comes after the judge in the case ruled in apartial summary judgmentthat Trump had submitted "fraudulent valuations" for his assets, leaving the trial to determine additional actions and what penalty, if any, the defendants should receive.

The former president has denied all wrongdoing and his attorneys have argued that Trump's alleged inflated valuations were a product of his business skill.

'This case has never been about politics,' James says

New York State Attorney General Letitia James, speaking to reporters outside court following the conclusion of closing arguments, dismissed the idea that her case against Donald Trump is about politics.

"This case has never been about politics, personal vendetta, or about name calling. This case is about the facts and the law, and Mr. Donald Trump violated the law," James said.

James thanked her team, the judge, and Trump's lawyers before repeating her confidence that "justice will be done" in the case.

"No matter how powerful you are, no matter how rich you are, no one is above the law," she said.

Closing arguments conclude, ruling expected by Jan. 31

Judge Arthur Engoron asked state attorney Kevin Wallace to conclude the day's proceedings by comparing Trump's fraud to the actions of financier Bernie Madoff, who defrauded clients out of tens of billions of dollars in the 1990s and 2000s.

"How would you compare the fraud you are alleging to the Madoff Ponzi scheme?" Engoron said.

During a meandering response, Wallace acknowledged that Trump's fraud was smaller, but "significant given the dollar amounts involved."

"If you are rich enough, you going to be allowed to do it. You'll get away with it," Wallace said.

Engoron concluded the day by estimating that he would issue an opinion in the case by Jan. 31.

He then ended the proceedings.

The buck stopped at Trump, state lawyer says

The buck stopped at Donald Trump, and the court should hold him responsible for his company's actions, according to state attorney Andrew Amer.

"The buck stopped with him, so he was responsible for all the conduct I just reviewed," Amer said about Trump's conduct between 2011 and 2015, before his sons took over the company when Trump won the White House.

Though defense attorneys have repeatedly criticized the testimony of former Trump lawyer Michael Cohen, Amer highlighted that Trump's lawyers never questioned the former president about his testimony that Trump instructed Cohen and then-CEO Allen Weisselberg to "reverse engineer" his financial statement to increase his net worth.

"Based on their decision not to question Mr. Trump on this critical point, the court should infer that the reverse engineering instructions were given by Mr. Trump, just as Mr. Cohen described," Amer said.

Amer also highlighted what he said wasEric Trump's inconsistent testimonyabout his knowledge of his father's statement of financial condition.

"He went to great lengths to conceal from this court that he was fully aware that his father had a personal financial statement," Amer said, claiming that Eric Trump and his brother Donald Trump Jr. "approved of and perpetuated those schemes with the intent to defraud."

Judge Engoron, however, appeared skeptical of Amer's argument about Trump's adult sons -- particularly Donald Trump Jr. -- and interrupted the summation to question Amer.

"What evidence do you have -- I just haven't seen it -- that they knew there was fraud?" Engoron said.

Amer responded that the sons should have known about the fraud given their role in the company, and that their inaction amounted to "sticking their heads in the sand."

"They can't say they didn't bother paying attention to it. That is just not a defense," Amer contended.

'Cash crunch' drove Trump to fraud, state alleges

The competing obligations between the costs of Donald Trump's 2016 presidential campaign and his business obligations created a "cash crunch" at the Trump Organization that motivated the former president to commit fraud, state attorney Kevin Wallace argued during his summation.

Wallace's theory about the motivation for the alleged fraud, which he articulated for the first time, attempted to explain Trump's motive for the alleged conduct as well as justify levying a fine against Trump in order to regulate the marketplace.

According to Wallace, the hundreds of millions of dollars saved by the Trump Organization through fraud allowed the company to "stay afloat" during a major "cash crunch" during the 2010s.

During the first half of the decade, the Trump Organization spent roughly $775 million to renovate properties including its Doral and Turnberry golf courses, as well as the Old Post Office building in Washington, D.C., Wallace said. The idea that the company could have funded these expenses with cash alone was a "fantasy," according to Wallace.

"By the time you get to 2017, Mr. Trump was becoming president, and the company was getting low on cash," Wallace said. Faced with the chance of a negative cash flow, the company opted to embrace fraud, according to Wallace.

"They didn't have to choose between their priorities," Wallace said about the company's business expenses and Trump's presidential campaign.

Trump attorney Chris Kise objected to the argument, suggesting the theory was nothing more than conjecture -- which prompted a heated exchange with Wallace.

"Chris. Stop. We didn't interrupt the defendants' presentation at all," Wallace shouted while facing Kise.

"I think I agree with Mr. Kise," Judge Engoron responded, but he allowed the presentation to continue.